Six Romantic Is Stripe Better Than Paypal Concepts

페이지 정보

작성자 Dominic 작성일 25-01-17 00:30 조회 5 댓글 0본문

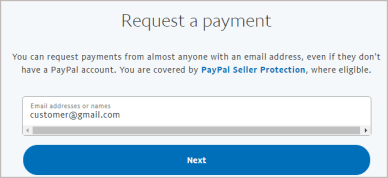

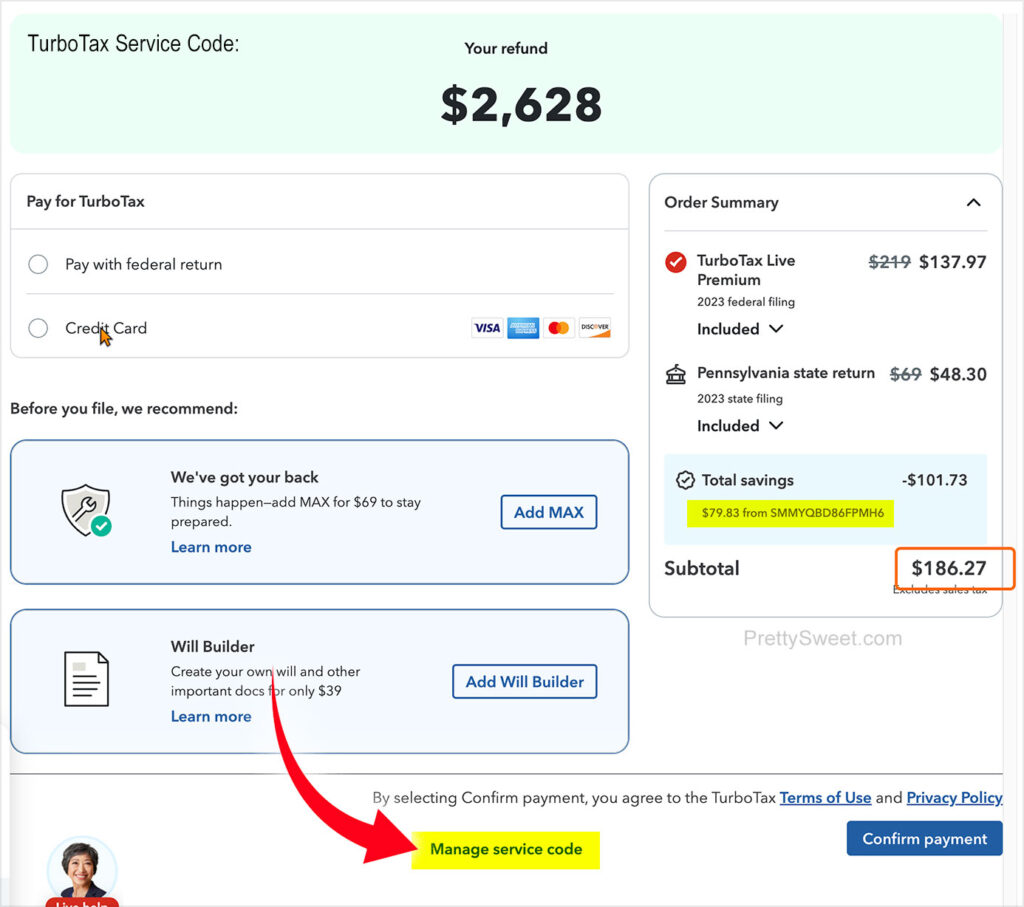

Once you’ve learn over the terms and situations, you could acknowledge and agree to them. After a certain time period, interest begins to accumulate and principal balances roll over into subsequent billing intervals. Credit playing cards are the most generally used type of revolving credit, providing grace intervals for customers to pay back cash borrowed, with out interest. Online direct lenders are inclined to have the quickest processing periods. paypal business account cost and Stripe are excellent selections for on-line fee processing. In different phrases, there are no surprises for shoppers, who know precisely what their month-to-month residence mortgage funds and automobile loan obligations will likely be. Once cards or different revolving credit strains are issued, primary month-to-month principal funds and curiosity rely upon the terms and situations contained within your individual cardholder agreement. The numbers of playing cards you use often, in addition to those which stay largely idle, are thought of alongside common balances and missed-fee histories. As you search funding for property, autos, personal prices, enterprise start-ups and different bills, you may be required to put your playing cards on the table, exhibiting lenders a snapshot of your borrowing history. We agree to adjust to any information request or deletion made pursuant to the CCPA in a reasonable timeframe, throughout normal enterprise hours and excluding holidays or Our pre-scheduled time off.

Once you’ve learn over the terms and situations, you could acknowledge and agree to them. After a certain time period, interest begins to accumulate and principal balances roll over into subsequent billing intervals. Credit playing cards are the most generally used type of revolving credit, providing grace intervals for customers to pay back cash borrowed, with out interest. Online direct lenders are inclined to have the quickest processing periods. paypal business account cost and Stripe are excellent selections for on-line fee processing. In different phrases, there are no surprises for shoppers, who know precisely what their month-to-month residence mortgage funds and automobile loan obligations will likely be. Once cards or different revolving credit strains are issued, primary month-to-month principal funds and curiosity rely upon the terms and situations contained within your individual cardholder agreement. The numbers of playing cards you use often, in addition to those which stay largely idle, are thought of alongside common balances and missed-fee histories. As you search funding for property, autos, personal prices, enterprise start-ups and different bills, you may be required to put your playing cards on the table, exhibiting lenders a snapshot of your borrowing history. We agree to adjust to any information request or deletion made pursuant to the CCPA in a reasonable timeframe, throughout normal enterprise hours and excluding holidays or Our pre-scheduled time off.

If applicants decide to lend from peer-to-peer lenders, loans can get permitted inside a few minutes up to some enterprise days. The company, like most lenders, requires users to pay 25 % up front, after which pay down the remaining balance over 4 equal biweekly installments. When you have a car or house mortgage; or perhaps a bank card, paypal verkäuferschutz kosten for that matter, the quantity you pay again each month reflects principal and interest payments applied towards the price of purchases. Installment credit represents borrowing normally related to the two major purchases concerning consumers: Homes and autos. Before borrowing for big-ticket items, consumers set up observe records of creditworthiness, using sound revolving credit score histories and other profitable financial transactions as an instance their skill to satisfy their obligations. Lastly, applicants that fall below the Exceptional class obtain the most effective borrowing rates. Applicants with Very Poor VantageScore ranking will most positively have their applications rejected, whereas people who fall under the Poor class must make do with disadvantageous rates and probably greater down funds.

If applicants decide to lend from peer-to-peer lenders, loans can get permitted inside a few minutes up to some enterprise days. The company, like most lenders, requires users to pay 25 % up front, after which pay down the remaining balance over 4 equal biweekly installments. When you have a car or house mortgage; or perhaps a bank card, paypal verkäuferschutz kosten for that matter, the quantity you pay again each month reflects principal and interest payments applied towards the price of purchases. Installment credit represents borrowing normally related to the two major purchases concerning consumers: Homes and autos. Before borrowing for big-ticket items, consumers set up observe records of creditworthiness, using sound revolving credit score histories and other profitable financial transactions as an instance their skill to satisfy their obligations. Lastly, applicants that fall below the Exceptional class obtain the most effective borrowing rates. Applicants with Very Poor VantageScore ranking will most positively have their applications rejected, whereas people who fall under the Poor class must make do with disadvantageous rates and probably greater down funds.

If an applicant has a poor rating , then the applicant will both obtain a loan rejection from the lender or be required to pay an upfront price or a significantly larger fee to qualify for financing. If we evaluate the average interest rate of non-public loans to other forms of financing, we will see they've rates below that of a bank card, although charge a bit greater than most secured forms of financing. We publish current local private loan charges to help borrowers evaluate charges they're provided with present market conditions and join borrowers with lenders offering aggressive rates. Actual interest charges will vary depending on an applicant’s credit score score, repayment historical past, income sources and the lender’s personal standards. Good scorers can get pleasure from aggressive lending charges, while Excellent scorers can have the most effective charges and essentially the most handy loan phrases. What are the standard interest charges for personal loans?

According to FICO® Scores, a credit score above 800 is tagged as Excellent, 750-799 credit score scores are Excellent, 700-749 scores are Good, 650-699 is Fair, 600-649 is Poor, and 300-599 could be very Bad. A rating of 781-850 is tagged as Excellent, 661-780 fall beneath the nice category, 601-660 is tagged as Fair, 500-600 is Poor, and 300-499 fall under Very Poor. Credit rating stories and bank statements are additionally an necessary for approval since this illustrates whether candidates have an excellent repayment historical past & is an efficient danger. Lenders will want to make sure that applicants are able to fulfilling their obligations, and one way to reduce the danger of non-cost & fraud is to ensure of that is by securing paperwork that present proof of earnings/employment. Lenders may use other assets to secure financing, reducing their threat & giving consumers lower charges. If an applicant has a fair VantageScore score , their loans can get accredited though not at preferrred charges. Applicants whose rating falls under Fair are usually considered as subprime borrowers by lending institutions. Mortgages, automotive loans and other personal loans are also thought-about when figuring out your credit score rating.

Here is more info in regards to what is paypal goods and services review the internet site.

댓글목록 0

등록된 댓글이 없습니다.